Big Banks as Financial Brokers

The worldwide banking market is experiencing deep changes: new governmental regulations and investor pressures for a better cost structure. Worldwide financial corporationsbuying local banks are part of the new scenarioand Latin American is not an exception in this context. Big financial institutions are positioned as the most important in the region, for example:

Source: “250 Mayores Bancos de la Región”. América Economía

When you take a look at the ranking for the four worldwide financial groups: Santander Group, BBVA, HSBC and Citi Group. These institutions currently face important challenges to bring their services to the local markets, from trying to understand their client’s culture to adopting commercial strategies to capitalize the investment realized. A permanent challenge is increasing the service quality and following of their customer needs, but this is an incredibly difficult thing to achieve.

Because of these situations start-ups are creating a new concept around banking with the focus on quality of service, with a very well-defined customer segment which offers a specific product offering. At first sight these tiny “banks” can be seen as competitors of the larger corporations, but their business models are actually complementary.

Brokers? Give services to other banks!

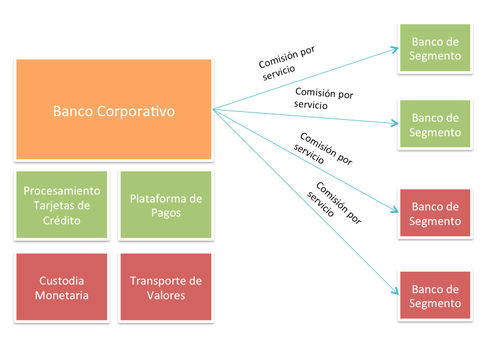

Banks have an infrastructure that lets them give different services to their customers, but that also implies a cost structure which, sometimes is an impediment in focusing the point on how to deliver a better service. We may think that these small start-up could be transformed into large Corporate Banks, which gives services to other segment banks, for example:

- Corporate Banks: On average, their revenue originate from service fees that they give the Segment Banks. The major advantage of this design is that they can focus in the improvement their process execution.

- Segment Banks: Are focused in the value creation for their customers, serving a one-to-one service charging them well-defined fees, which are calculated using their behavior in the use of their service.

Customers are starting to search their banks not only for credit cards or a checking accounts, but also for a proactive partner that will help them define a better way to invest or spend money.

The business of receiving deposits and converting them to loans is more of a struggle in margins because of the market competence. There is a huge invitation for banks to rethink and search for new business models that let them have a closer proximity to their customers and understand their needs to develop new financial solutions. With this path, we can not go wrong.